An Employer Identification Number (EIN) is a unique nine-digit number issued by the IRS. It serves as a business’s tax identification number and is essential for various purposes like opening a business bank account, hiring employees, and filing taxes. This comprehensive guide will explain what an EIN is, why it’s necessary, and how to apply for one step by step, whether you’re a U.S. citizen or a non-resident.

What is an EIN?

An Employer Identification Number (EIN) is the federal tax ID number used to identify a business entity. Think of it as the equivalent of a Social Security Number (SSN) but specifically for businesses. EINs are issued by the IRS and are required for businesses operating in the U.S. that meet certain criteria, such as hiring employees or operating as a corporation or partnership.

Why Do You Need an EIN?

Having an EIN is crucial for several reasons:

- Tax Filing: Businesses must use an EIN for filing federal and state taxes.

- Business Bank Accounts: Most banks require an EIN to open a business account.

- Hiring Employees: If your business plans to hire employees, an EIN is mandatory.

- Business Credit: Establishing business credit often starts with having an EIN.

- Licenses and Permits: Some state and local permits require an EIN during the application process.

How to Apply for an EIN

The process for obtaining an EIN varies slightly depending on whether you are a U.S. citizen with an SSN or a non-resident without one. Here’s a breakdown:

For U.S. Citizens (with SSN):

- Visit the IRS Website: Navigate to the IRS EIN Assistant page.

- Complete the Online Application:

- Select the type of entity you’re forming (e.g., LLC, Corporation, Sole Proprietorship).

- Provide basic business information, such as the name, address, and responsible party.

- Submit the Application: Once completed, submit the application online.

- Receive Your EIN Instantly: Upon approval, you’ll receive your EIN immediately on the confirmation page. Save this document for your records.

For Non-U.S. Citizens (without SSN):

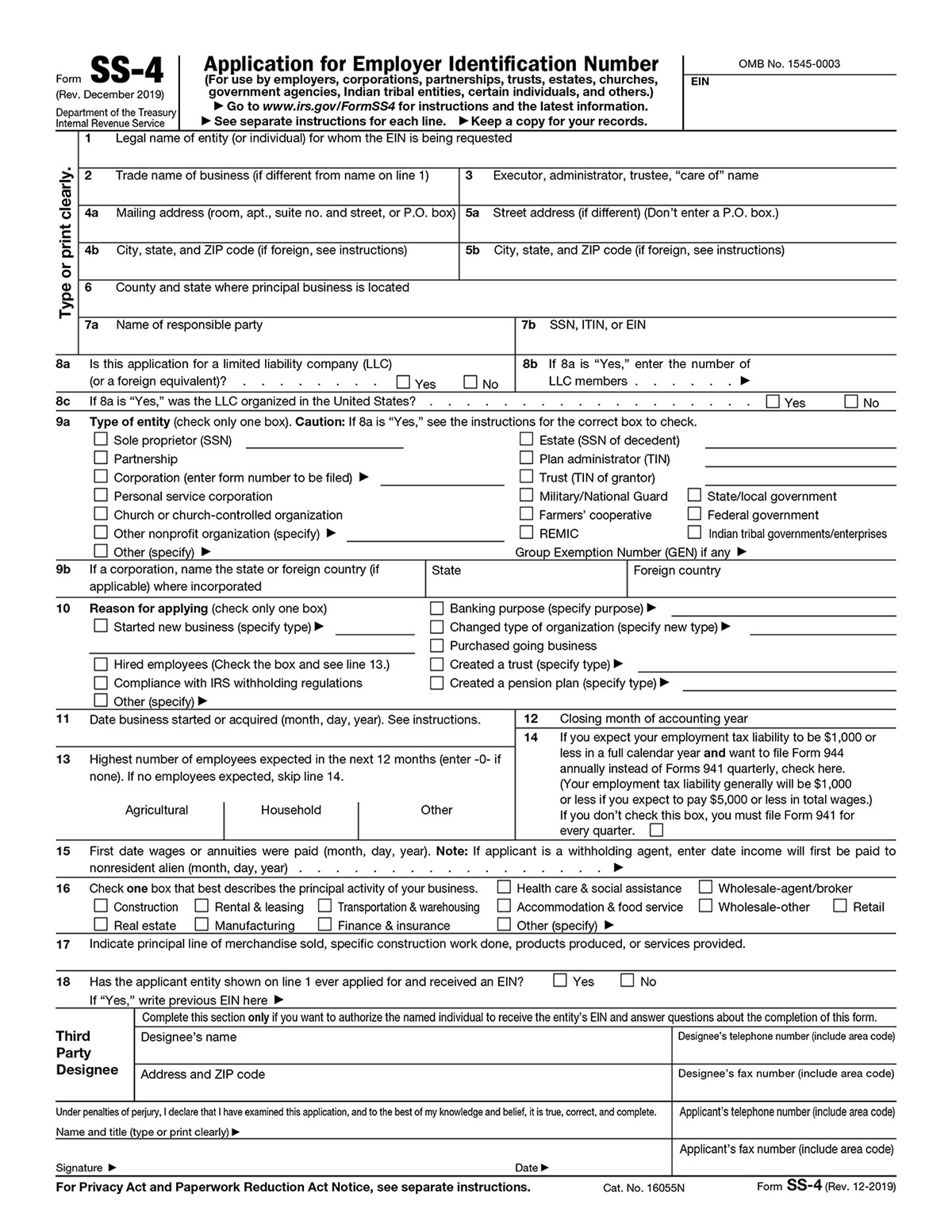

- Download Form SS-4: Obtain the form from the IRS website.

- Complete Form SS-4: Follow these steps carefully if applying as a FOREIGN-OWNED US DISREGARDED ENTITY:

- Line 1: Enter the legal name of the entity (e.g., LLC) and the trade name, if applicable.

- Line 2: Leave blank unless the trade name differs significantly from the legal name.

- Line 3: Enter the name of the responsible party (usually the owner of the foreign entity).

- Line 4a and 4b: Enter your US company address (Registered Agent address) in this field. The EIN letter will be mailed to this address

- Line 5a and 5b: Leave these fields blank.

- Line 6: Enter the city and state where your company address is located. For example: Sheridan, Wyoming

- Line 7a and 7b: Enter the responsible party’s name. Leave 7b (SSN/ITIN) blank if unavailable.FOREIGN

- Line 8a, 8b, and 8c: For example: 8a LLC > Yes, 8b 1 (how many people are members of the LLC). 8c YES

- Line 9a: Select “Other” and specify “Foreign-owned U.S. disregarded entity.”

- Line 9b: Enter the country of formation State. For Example : Wyoming

- Line 10: Started new business (specify type). LLC

- Line 11: Enter the date the entity was started or acquired in the U.S

- Line 12: . Enter the closing month of the entity’s accounting year (usually December).

- Line 13-15: Leave blank unless applicable.

- Line 16: Select the primary activity of the business (e.g., “Services”).

- Lines 17-18: 17: Complete if applicable to your business activity. 18: No

- Signature Section: Sign and date the form. Ensure the signer is authorized to act on behalf of the entity.

- Fax or Mail the Form:

- Fax the completed form to +1-855-641-6935 (for international applications) or mail it to: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999, USA.

- Wait for Processing: Processing times vary. Fax applications typically take 4-5 business days, while mailed applications can take up to 4 weeks.

- Receive Your EIN: The IRS will send your EIN confirmation via fax or mail based on your submission method.

Where to Check for EIN Results

- Online Applications: If applied online, your EIN is issued instantly and displayed on the confirmation page.

- Fax Submissions: If faxed, you’ll receive a response within a few business days.

- Mail Submissions: If mailed, expect your EIN letter to arrive in approximately 4 weeks.

If you don’t receive your EIN within the expected timeframe, contact the IRS Business & Specialty Tax Line at +1-800-829-4933 (Monday to Friday, 7 a.m. to 7 p.m. EST).

Tips for a Smooth EIN Application Process

- Double-Check Your Information: Ensure all information matches your formation documents.

- Apply Early: Don’t wait until the last minute; allow enough time for processing.

- Keep Records: Save all confirmation emails, fax receipts, and IRS correspondence.

Frequently Asked Questions About EIN Applications

Can I apply for an EIN online as a non-resident?

No, the online application is only available for U.S. citizens or individuals with an SSN or ITIN. Non-residents must apply by fax or mail using Form SS-4.

Is there a fee to apply for an EIN?

No, the IRS does not charge any fees for issuing an EIN.

What if I lose my EIN?

If you lose your EIN, you can retrieve it by contacting the IRS Business & Specialty Tax Line at +1-800-829-4933. Be prepared to verify your identity.

Can I use one EIN for multiple businesses?

No, each business entity requires its own EIN. However, a single EIN can cover multiple locations of the same business.

How long does it take to receive an EIN by mail?

Mailed applications typically take up to 4 weeks to process. For faster results, consider applying by fax if you’re a non-resident.

Applying for an EIN is a critical step in establishing your business. With the right preparation and understanding of the process, you can obtain your EIN quickly and focus on growing your business.